Ferbuary 10, 2025 - Backtracking to the 1890s...

- Konstantinos Tzavras, CIO

- Feb 3, 2025

- 6 min read

President Trump has repeatedly expressed his admiration for President McKinley (1897-1901) and he even changed the name of the Denali mountain in Alaska, the highest in North America, to its original Mount McKinley on his first day in office. McKinley, the President, is primarily known for three things: i) high tariffs, ii) plutocrat-friendly policies (essentially owing his election to the Rockefellers) and iii) the imperialistic expansion of the US. He also placed the USD on the Gold Standard, which perhaps represents the bitcoin of the time.

A quick look at his economic and political agenda is enough to understand why Trump references him so frequently. In 1897, he passed the Dingley Tariffs act, with which he sought to increase his own tariffs from the early 1890s (as a just Representative then) and almost doubled them in some cases. These new, higher tariffs remained in place for twelve years, making it the longest-lasting in US history and averaged more than 50%, which is also the highest imposed import tax in the history of the US. President McKinley also declared the Spanish-American war of 1898, at the end of which Spain turned over to the US, the regions of Puerto Rico, Guam and the Philippines, while Cuba was promised independence but under US control. And as McKinley was considered by many a "puppet" of John Rockefeller, perhaps the wealthiest US person of the time, Trump's love affair with Musk and other billionaires also draws some parallels. Even the assassination attempt on Trump presents an eerie similarity, as McKinley was eventually assassinated by an anarchist, factory worker in 1901.

We are not sure whether a return to the late 1890s would constitute progress or a return to a rather dark age of geopolitical and economic isolation, a dented democracy and eventually an economic crisis. The Trump/Musk coalition which has put "America first" at any cost, could eventually isolate the US from the world, agitate its own allies, unite every non-friendly nation against them, not to mention the high risk to US consumers and investors, as the risk for re-igniting inflation is high.

Trump made headlines again last week on various fronts. He announced a 10% tariff on all Chinese imports but he also took back the 25% tariffs on Mexico and Canada, after the latter pledged to increase border security. The speed of his changing his mind and decisions is something that we must be prepared for, as the tariffs were supposed to tackle the trade deficit and not border security, which is also another issue. Still he felt he won something and of course his aids told him that the 25% tariffs on the US's main partners in the region could be catastrophic. The European Union comes next, most probably. China chose to retaliate in a rather muted manner, imposing 10% tariffs on LNG, oil and some farm equipment , but the volume of trade in these products between the two countries is rather small compared to the total. Trump also continued his imperialistic communique, shocking the world with his public comment that "the US will take over Gaza", a few days after he had a spat with the Danish PM about Greenland's fate, not to mention his public view that Canada could be the 51st state and Panama should be under US control.

As a result, US equities had a volatile week, and finally finished in the red. The S&P500 lost 0.2% and is now just 1% higher from the level it reached on Trump's enthusiastic election day, while Nasdaq dropped 0.5% for the week. At the same time, Hang Seng rallied 4.5% and local chinese markets moved higher by 2% on average. Europe continues to surprise positively with a 0.5% gain on average, despite the negative performance of US markets. Tariffs on the region are a major overhang, however, although the EU leaders have been working diligently to either find ways to retaliate or make compromises, especially on US automobiles import taxes.

The US January labor market data were rather ok, despite the headline miss. Nonfarm payrolls were announced at 143k in January, with private employment up a soft 111k, lower than expectations. But the December gains were revised up notably, despite downward revisions to a lot of other months, that when combined with the strike and hurricane related rebound in November, makes the recent labor market data look pretty solid. The unemployment rate edged down to 4%, from 4.1%. The data continue to be consistent with no rate cut in the horizon by the FED.

Eurozone January inflation was rather on the positive side. The headline rose 0.1pp to 2.5% y/y, slightly above consensus expectations of unchanged at 2.4%, while Core inflation remained at 2.7% y/y, in-line with expectations. At the component level, higher energy inflation was the key driver behind the increase in the headline number, which provides some optimism that the rise is temporary. Within core, services inflation came in line with expectations, edging down 0.1pp to 3.9% y/y, which is a welcome development in the context of the ECB's expectations of easing services inflation this year, as it has already happened with consumer goods. We have the view that given the base effect and the current run-rate of services inflation, the headline Eurozone CPI can fall much lower than the 2% target , by the end of the first half of 2025.

Looking forward, there are more reasons to believe that EUR rates can fall significantly by the end of this year. The central bank's wage tracker revealed a very steep slowdown in the pace of anticipated wage growth. It is now tracking wage growth by Q4 2025 at 1.5%, down from 5.3% in Q4 2024. If this estimate realizes, that would be the slowest pace of wage growth since Q1 2022 and in-line with the last five year's annual average. This is a big deal for the ECB as during last week’s press conference, President Lagarde stressed that it was only wage growth – and especially that in the service sector – that was holding inflation up. With this now signaling a sharp slowdown, the ECB has no reason to resist cuts. And if US tariffs are imposed, then cuts will take place beyond what is already priced-in.

As expected, the Bank of England cut its policy rate by 25bp to 4.5%. The decision was supported by 7 members, while 2 members voted for a larger 50bp rate cut, which surprisingly included Catherine Mann, previously the most hawkish MPC member. The minutes suggest that Ms. Mann was in favor of a “more activist approach at this meeting [that] would give a clearer signal of financial conditions appropriate for the UK, even as monetary policy would need to remain restrictive for some time to anchor inflation expectations, and Bank Rate would likely stay high given structural persistence and macroeconomic volatility”. This suggests that the 50bp rate cut vote from her side might have been a one-off. The current market expectations are that the BoE will pause in March and rate cuts will take place with quarterly frequency in H1-25, before accelerating to cutting at every meeting in H2-25 bringing the rate to to 3.25% by end-25.

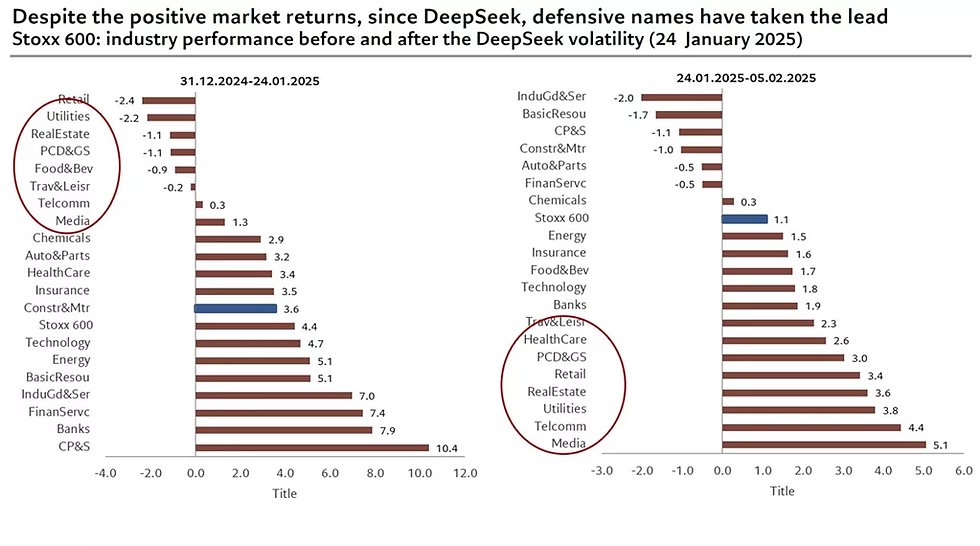

Chart of the Week : Defensives take the lead in Europe, since DeepSeek's emergence.

The above chart was compiled by Pictet and shows the performance of various European sectors and industries in two different periods. On the left, we find the performances since the start of the year and until the day that DeepSeek made headlines with their AI open-source platform. We see that the defensive sectors such as Utilities, Food&Beverage and Telecoms were severely underperforming the broad market, whereas Sectors like Industrials and Banks had already gained more than 7% in that period. But if we take a look on the right, we have the performances of the same sectors since Monday 24th January and there is an almost perfect mirror image. The sectors which had a negative start of the year rallied more than 4% in just a few days and are starting to close the gap, as Industrials, Autos and Technology have been underperforming. It is too early to conclude whether this rotation has legs or not. The only lesson is that diversification minimizes volatility and has the potential for good returns, as long as the companies which are selected are high quality, with sound business models and attractive-to-fair valuation. This year is perhaps not the year to be invested only in expensive stocks or sectors.

Disclaimer

• The content of this document has been produced from publicly available information as well as from internal research and rigorous efforts have been made to verify the accuracy and reasonableness of the hypotheses used. Although unlikely, omissions or errors might however happen.

• The data included in this document are based on past performances and do not constitute an indicator or a guarantee of future performances. Performances are not constant over time and can be positive or negative.

• This document is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument and it should not be considered as investment advice. The market valuations, views, and calculations contained herein are estimates only and are subject to change without notice. Any investment decision needs to be discussed with your advisor and cannot be based only on this document.

• This document is strictly confidential and should not be distributed further without the explicit consent of Kendra Securities House SA.

• Sources: Chart of the Week : Pictet

Comments